Borrell Refines Local Digital Ad Market Segments

Borrell has introduced Digital Marketing Regions as an alternative to DMAs. While Nielsen tracks 210 DMAs, Borrell's DMRs encompass 513 markets.

Borrell has introduced Digital Marketing Regions as an alternative to DMAs. While Nielsen tracks 210 DMAs, Borrell's DMRs encompass 513 markets.

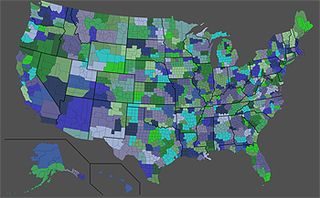

Local media research firm Borrell Associates wants to help local media companies get a better grasp on their digital ad market share. For many, data on Designated Market Areas – otherwise referred to as Television Market Areas – encompass areas that are too large to provide an accurate reading, so Borrell has introduced Digital Marketing Regions as an alternative to DMAs. While Nielsen tracks 210 DMAs, Borrell’s DMRs encompass 513 markets.

Local media research firm Borrell Associates wants to help local media companies get a better grasp on their digital ad market share. For many, data on Designated Market Areas – otherwise referred to as Television Market Areas – encompass areas that are too large to provide an accurate reading, so Borrell has introduced Digital Marketing Regions as an alternative to DMAs. While Nielsen tracks 210 DMAs, Borrell’s DMRs encompass 513 markets.

On average, most local media outlets can reach 28 percent share of their DMAs at the most, with many hitting only in the single digits, said Borrell Associates CEO Gordon Borrell. But that can change drastically when looking at the more hyper-local DMRs. “You get up to…about 42 percent, but there are many, many more companies at the higher ranges,” he said. He argued that the new regional system provides media firms with a better outlook on the amount of digital ad dollars they have the potential to earn in a given region.

While the average DMR takes in $36 million in local digital ad spending, the median DMR generates $10.6 million in digital ad revenue, reported Borrell. And then there are DMRs like Emporia, Kansas that sit within larger DMAs and draw far less – $1.39 million according to Borrell.

“If [AOL-owned local site network] Patch had this available to them several years ago before they started building out,” he suggested, the company might have launched in a more select number of markets based on more-specific data. Patch, acquired by AOL in 2009, has struggled since its ’07 launch, but the company reported “strong” revenue growth in Q2 of this year.

According to Borrell, his firm has been developing the DMR concept over the past two years, and worked with local media firms to refine the regions measured.

The disparities between DMAs and DMRs are especially clear in places such as the northeast, Borrell said. For instance, Boston, Philadelphia and Washington, D.C. are in the top 10 DMAs based on the number of TV households in each. But Borrell believes DMRs are a more appropriate measure of these larger areas because there are lots of smaller markets within each.

“If you look at some of the bigger markets… there are all these little population markets up there,” he said. “These are hyper-local; these are more villages than they are big DMAs.”

Borrell recently forecasted 30 percent growth in local digital ad revenues in 2013 to $24.4 billion.