Latest

View MoreWhy Your CFO Doesn't Trust Your Marketing Numbers

Why Your CFO Doesn't Trust Your Marketing Numbers

A Q&A with McCall Milligan, Head of Data Science at Fospha, on building the trust layer that makes measurement actually useful Every marketer has ...

View articleWhat Changed in Retail Between eTail Palm Springs 2025 and 2026

What Changed in Retail Between eTail Palm Springs ...

When eTail Palm Springs convened in February 2025, the mood was cautious optimism. AI dominated almost every stage and hallway conversation, but the q...

View articleThe Brands AI Agents Will Recommend Are Already Pulling Ahead

The Brands AI Agents Will Recommend Are Already Pu...

For two decades, marketing invested in being findable. But as shopping moves inside AI conversations, the question facing senior marketers has changed...

View articleWhy Retail Marketing Teams Are Reorganizing Around Social Commerce and UGC

Why Retail Marketing Teams Are Reorganizing Around...

Marketing teams are being reshaped by fluid shopping behavior, tighter budgets, and the collapse of the traditional funnel. In this conversation, Cour...

View articleZero-Click Search: What Marketers Get Wrong (and What to Do Next)

Zero-Click Search: What Marketers Get Wrong (and W...

Charlie Clark, Founder of Minty Digital explains why SEO fundamentals still underpin both traditional and AI search visibility, even as zero-click beh...

View articleA Recap of NRF2026: Click's Main Takeaways

At NRF 2026, the signal was clear: AI is rewriting discovery, but the brands that win will be the ones that keep the customer promise, online, in-stor...

View articleEvent Highlights

View MoreAdvance 2025 Opened in New York with a Call for Reinvention

Advance 2025 Opened in New York with a Call for Re...

Smartly CEO Laura Desmond opened Advance 2025 with a call for AI-driven reinvention, urging marketers to act decisively in the AI era. Read More...

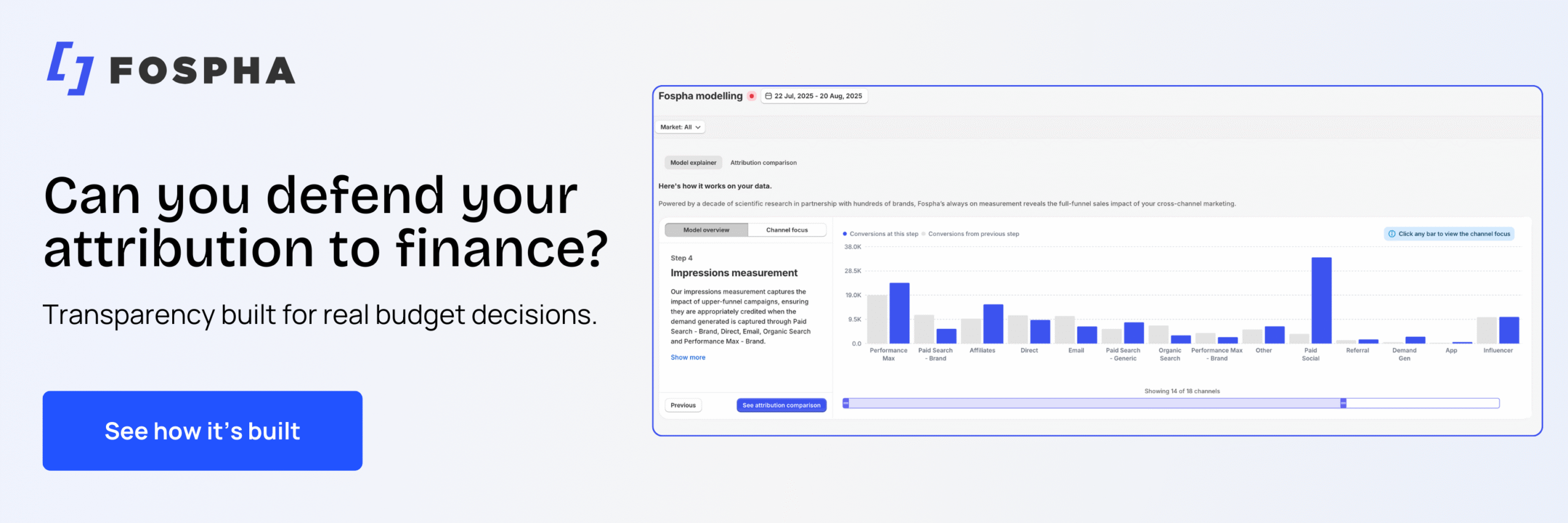

View articleBeyond the Click: How Marketers Can Now Rethink Measurement

Beyond the Click: How Marketers Can Now Rethink Me...

Insights from a ClickZ event with Fospha and Google on the future of advertising measurement Read More...

View articleWhat Cannes 2025 Got Right (and Missed) About Brand

What Cannes 2025 Got Right (and Missed) About Bran...

By Sam Carter, CEO of Fospha Read More

View articleThe Retail Imperative: Data, AI and the New Consumer Reality

The Retail Imperative: Data, AI and the New Consum...

Retailers used to worry about whether customers would migrate online. Today they fret about whether their data can keep up. From New York to LA, the t...

View articleCES 2025 Wrapped For Marketers

AI, IoT, and immersive tech are changing how brands connect with consumers Read More...

View article