The Necessity of Competitive Intelligence

It's important that you understand your competitors' frequency, use of personalization, and other apparent marketing tactics.

It's important that you understand your competitors' frequency, use of personalization, and other apparent marketing tactics.

In my work with clients, it is often surprising to find out how few of them have a formal competitive review process in place. At my firm, we find that most marketers simply subscribe to their competitors’ email promotions and newsletters but do little more analysis of their programs other than this.

While certainly there is enough work to focus on without adding yet another rung on the optimization ladder, there can be a tremendous amount of information to be gleamed from what your competitors are doing. That said, marketers should place appropriate emphasis on competitive insight to not have it completely upset an organization’s own vision and strategy of what is most appropriate for their own programs. Still, understanding a competitor’s frequency, use of personalization, and other apparent marketing tactics is necessary, but unfortunately for most an untapped supply of knowledge.

Late last year my firm published a study about the competitive intelligence tactics that marketers were using. The survey included responses from 333 marketing executives. The survey screened out executives who were unfamiliar with their organization’s email marketing efforts as well as organizations with fewer than 10,000 customer records. The data features a balance of B2C and B2B senders. While the survey includes responses from a variety of industries, the industry focus mainly consisted of financial services, retail, travel/hospitality, and media/publishing.

The survey results were remarkable as we found that the inability for email marketers to benchmark their program performance against their peers hinders optimization opportunities and obscures relative benefits that such comparisons can offer. Email marketers are well aware of this deficit, citing the inability to benchmark email performance against industry peers as one of their top five challenges. Thirty-seven percent of marketers surveyed stated that “greater use of analytics in order to optimize our communications” was the top priority for marketers this year, followed closely by the desire for marketers to improve their inbox placement. Nearly a quarter (24 percent) stated that they plan on analyzing their competitors’ email marketing messages. Lastly we found that email marketers who utilize competitive analysis tools contribute more corporate revenue from email than those who don’t.

There are several vendors that can provide this deep competitive analysis, most notably Return Path (full disclosure: Return Path sponsored the research) and eDataSource. Beyond those tools, as a marketer you must compel your email service provider (ESP), agencies, and strategy partners to make this kind of competitive intelligence a monthly exercise. Demand from your partners that their strategy advice is built on the research of your competitors and email marketing peers.

Marketers Lack Competitive Insight and Benchmark Measures

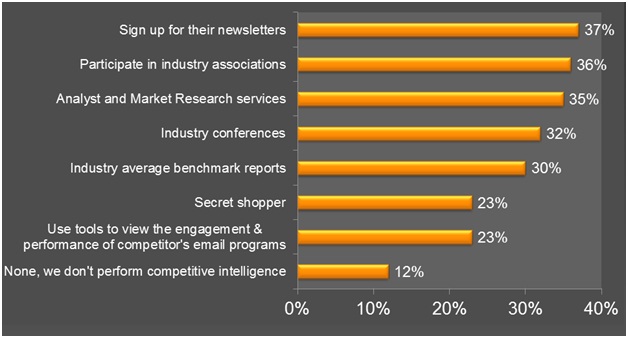

The inability for email marketers to benchmark their programs’ performance against their peers hinders optimization opportunities and obscures relative consequences that such benefits can offer. Email marketers are well aware of this deficit, citing the inability to benchmark email performance against industry peers as one of their top five challenges. Overall, less than a quarter (23 percent) of marketers surveyed stated that they use a tool to view the performance and engagement of their competitors’ email (see figure 1). While the majority of email marketers do nothing to investigate what their competitors are doing, some (37 percent) email marketers simply sign up for their competitors’ email as the primary means of competitive intelligence. Competitive insight and benchmarking can also help address another top five marketing challenge: managing and understanding frequency. Competitive benchmarking tools can not only show competitive metrics such as read rate and delivery, but also can highlight when and how often competitors are sending messages. Understanding competitor frequency as well as which subject lines are driving higher read rates are invaluable resources when optimizing email marketing programs.

Figure 1 – Email Marketing Methods of Competitive Intelligence, 2012

Question: How do you get competitive intelligence on your competitor’s email marketing program? (Source: The Relevancy Group, LLC, Return Path, Inc. Executive Survey, n=333 8/12, United States Only)

Question: How do you get competitive intelligence on your competitor’s email marketing program? (Source: The Relevancy Group, LLC, Return Path, Inc. Executive Survey, n=333 8/12, United States Only)

Email marketers who utilize competitive analysis tools contribute more corporate revenue fom email than those who don’t.

Our survey data indicate that a significant revenue lift can be attained when the marketers use competitive analysis tools. When normalizing our survey respondents based on monthly send size and corporate revenue, we contrasted their email revenue contribution by one attribute: those who used a competitive analysis tool and those who did not.

Fifty-six percent of marketers, whose email programs contribute 25 percent or more of their overall corporate revenue, use an email marketing competitive analysis tool. In comparison of marketers not using a competitive tool, the majority (68 percent) reported email corporate revenue contributions of 15.1 percent to 20 percent. Marketers utilizing competitive email marketing intelligence and applying that to their programs experience a significant revenue lift.

Marketers Who Utilize Competitive Analysis Tools Are More Sophisticated

Across the board on a variety of tactics, including the use of testing, segmentation, and dynamic content, marketers who enlist a solution to view their competitors’ email performance are more sophisticated than their peers who do not. It stands to reason that with further competitive insight, marketers will organically strive to do more and be better than their competitors. For example, when comparing marketer tactics based on their use of competitive intelligence, the following differences were exposed:

I leave you with a variety of tactics and ideas to make your program stronger. Given that it’s now spring here in North America, this might be the best time for you to refresh your practices and strategy.

All the best,

David

Image on home page via Shutterstock..

Leave a Reply

You must be logged in to post a comment.