How three financial service brands are killing it on Instagram and Pinterest

Last week I wrote about the general performance of B2B brands on various social channels. One of the most interesting takeaways was that, despite the focus on LinkedIn by many, the strongest engagement figures were often coming from newer channels, with Instagram proving particularly popular.

It was also notable that financial services far outpaced other professional service brands when it came to engagement. I thought it would be interesting to take a closer look at how this industry – which traditionally has a slightly dour reputation – is making use of visual social media.

But first… stats!

It’s always nice to have some figures behind these things, so let’s take a quick look at the audience figures. According to this report, the top 37 B2B financial service groups have a median following of 240,000 on Linkedin, compared to just 1,000 followers on Pinterest.

However, those small groups are highly engaged. Pinterest followers had an engagement ratio (average likelihood to engage per post, per 1,000 followers) of 69. 92. That’s more than 12,000% higher than the Linkedin audience.

I’m not going to trawl through every brand that was covered in the research, so instead I picked a few big fish (Allianz, CITI and J.P.Morgan) to look at in more detail and see what is causing this disparity.

Let’s start with LinkedIn. This is where the largest audiences exist; so it makes sense there will be some interesting content here.

Insurance and Asset Management giant Allianz have a mix of fairly standard posts on their page. The focus is clearly internal, with a clear recruitment angle. The business also covers internal culture to an extent – interviews with the C-Suite pop up regularly – and cover various social responsibility initiatives that the business is running.

There is some deeper content here, with whitepaper-style pieces covering specific verticals, but generally speaking these posts focus on the company and it’s employees, while product information is delivered with a definite sales information angle.

Next up, CITI, with almost a million followers on Linkedin.

Again, there’s a lot covering the company’s more worthy pursuits, including their large solar panel initiatives, and their support for women’s groups around the world.

There are also a few intelligence posts here, looking at the new role of Fintech, and some information on products delivered as articles. Recruitment also pops up occasionally, again with C-Suite interviews focusing on what it takes to work for CITI:

Finally I looked at J.P Morgan… and we’re back on familiar ground.

Recently the company pushed lots of content covering Women’s History Month. A laudable initiative, with focus on female employees at JP around the world (There is a line of thought that suggests the spotlight shouldn’t need to be moved to feature them in the first place, but that’s an argument for another time and place).

However, it feels as though all of this content was created with one eye on recruitment. Again there are also posts showcasing the working environment at JP, and some insight posts from senior staff dotted throughout.

Overall, LinkedIn is fairly straightforward. Focus is on recruitment and HR, with some thought leadership and analysis tacked on. Most posts focus inward, talking about the company and it’s achievements.

As an aside, I also took a quick look at State Street’s page.

State Street only maintain Twitter and LinkedIn profiles, so I didn’t include them in the final roundup, but the company was worth a mention as they don’t seem afraid to step out of the box a little, with lots of information on emerging topics such as blockchain, volatile market opportunities, and curated content from other sources. It’s slightly more interesting as an outsider, but much of their own content is a little top-level. It is nice to see graphics being used heavily to communicate complex information, but more investment would help here.

Based purely on those big engagement rates, I’m going to use Pinterest for this.

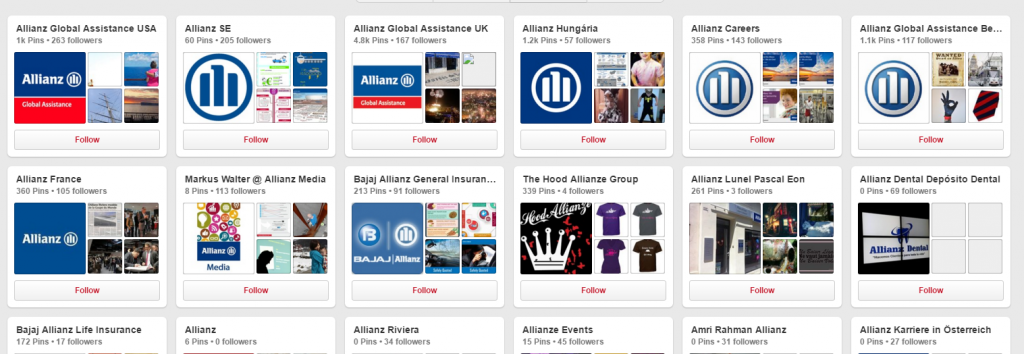

What’s striking here is the sheer number of accounts available, with different business verticals in different territories having their own voices. The US, UK, Hungary, Belgium… the list goes on, while the Careers Portal also warrants it’s own account.

I’m going to zoom in on the USA-specific account for a moment. With more than 1,000 pins its certainly no slouch. And this is where things get interesting:

None of these boards focus on the products themselves, but instead look at situations where customers might make use of the product – while travelling.

Let’s see if the other brands reflect this.

Citi doesn’t maintain Pinterest accounts, but it is active on Instagram.

Oddly, the content here covers many of the same themes as the LinkedIn account; Social initiatives and recruitment. However – and despite the cheesy corporate music accompanying some of the posts – everything here is far more dynamic and engaging.

https://www.instagram.com/p/BBITs6op_uI/?taken-by=citi

Video is utilised heavily, while posts about global initiatives are accompanied by stunning photography. Being able to see and hear directly from the people involved, with a focus on how their career is affecting their life helps followers connect more effectively with the business. The focus is, predictably, on the millennial market, and while the corporate voice is hardly ‘in touch’, the platform format itself is forcing Citi to be more interesting here. As a caveat – take a look at the Citibank account as well, which is doing some far more engaging stuff, again by basing updates on use cases.

JPM is lagging on social, without a brand account on any of the major visual platforms (I checked out Pinterest, where people are mainly concerned with sharing historical images from the firm’s… storied history), but does maintain an Instagram account for Chase Bank so let’s take a look there.

It’s a bit of a mixed bag to be honest. Chase’ brand identity revolves around the word ‘freedom’, and there’s some attempt to communicate that here, with Images from events around the world, and lots of people doing that whole ‘just keep on being you’ thing so beloved of large corporations.

There is also plenty of exclusive content, including recent behind-the-scene’s looks at the founders of The Skimm (A daily news roundup email. It’s very good. And so is the ClickZ newsletter. Not that I’m mentioning that for any particular reason obviously), and field trips to Sundance Film Festival. Again, content skews younger, and it’s clearly been put together with the platform specifically in mind.

https://www.instagram.com/p/BA-KSg9wYcO/?taken-by=chase

So, what can we learn from this?

The key takeaways are clear – focus on the customer, and tailor content to the platform. Financial Service operations are utilising LinkedIn as a recruitment platform, which does count as a specific function, but it’s not a highly engaging or shareable one.

Even the largest businesses in the world have a finite talent pool of graduates or senior staff. Many of these businesses are using LinkedIn to share content that has been created with another medium in mind. Even video is not always comfortable on LinkedIn, and it’s not the most aesthetically pleasing platform. It may make more sense to focus not on numbers here, or even high engagement, but instead to look at how you can use it to position very specific content in front of highly relevant people. Even one click is good if it comes from a potentially large customer.

The really interesting point here is that using different platforms can give a new lease of life to fairly staid messaging. Recruitment wears a much more human face on Instagram, with the focus on the benefits for those interested, rather than for the company. Similarly product updates are based on use cases, with a tone of voice that shows the user intent and benefit, rather than just promoting the brand.

It’s interesting because these are very traditional organisations, and their ideas of what can be positioned as ‘fun’ or even’ useful’ have to filter through many layers of compliance before they reach the user, but simply by shifting the message focus and showing how they can actually help customers as individuals, they are driving massive engagement.

Leave a Reply

You must be logged in to post a comment.