30-second summary:

- Consumer demand and interests have changed as people are increasingly shopping for products they never purchased online before.

- Due to the coronavirus pandemic, consumer interest in online shopping has increased by 50% YoY.

- Ecommerce sites are seeing traffic numbers exceeding the holiday-time shopping spikes, hitting a 25 billion monthly visits mark.

- While digital ad spend is down by an average of 20%, ecommerce businesses might see an opportunity in the midst of the crisis as CPC costs are also decreasing.

The global pandemic has turned the tables on how ecommerce brands do business. While the full impact of COVID-19 is yet to be assessed, some market trends can already be spotted and put to use by ecommerce businesses that want to stay afloat in the slowing economy.

Having analyzed 2000+ of the largest ecommerce sites worldwide from various industries, SEMrush pinpointed the key shifts in consumer demand and the overall digital marketing landscape.

Defining the key shifts in consumer demand

Recent changes in ecommerce market trends are largely driven by profound shifts in customer demand. With a lot of attention given to the pandemic’s impact on consumer behavior, consumer preferences are also a crucial area to look at when trying to define the ‘new customer’.

With ecommerce businesses, to understand consumer demand we should look into the most popular products people are searching for online.

Comparing the average monthly search volume data from the first half of 2019 to that of 2020, some product categories are showing impressive spikes in consumer interest:

- Hand wash is now among the top 5 most searched products within the Health Looking at YoY Spring data, the demand for hand sanitizers impressively grew by +19038%, while other similar products also saw a significant increase in searches.

- As many people are working from home, monitors, webcams, as well as office chairs can be found in the list of top 5 products in Consumer Electronics and Home and Garden categories, respectively.

- With people spending more time indoors, consumers have been stocking up fridges throughout the pandemic, affecting online searches for frozen foods: demand for frozen bread grew by 5X, while frozen meat, vegetables, snacks and pizza make it to the top 10 most searched items within the Food category.

- Stay-at-home orders also helped increase searches for outdoor activity items like garden chairs (+168%) and outdoor toys for kids (+253%). Interest in sports products like running clothing and yoga mats have almost doubled and quadrupled respectively.

- The COVID-19 pandemic changed the way people celebrate anniversaries, birthdays, and other holidays, but it also affected the kinds of presents consumers are searching for: cheese and beer gift box searches have grown by more than 300%, making them the most popular products within the Gifts sector.

Global ecommerce website traffic is up

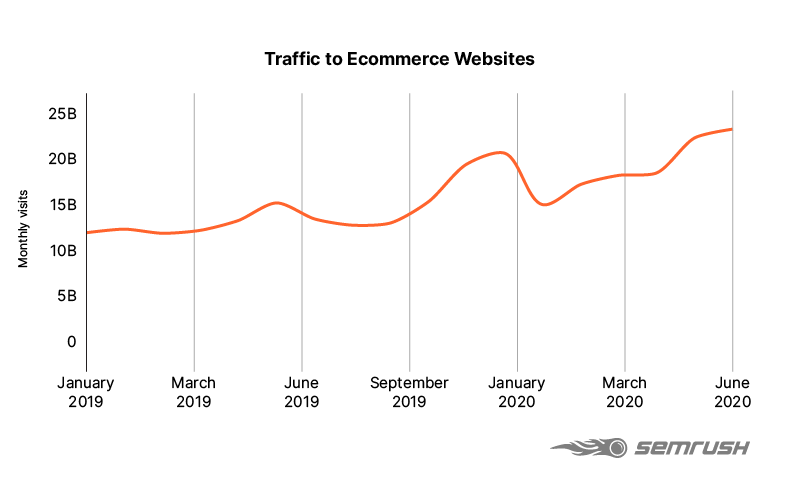

With brick and mortar shopping on the decline, year-on-year (2019 vs. 2020) June searches for ‘’buy online’’ rose by 50% globally. As consumers turned to online shopping, ecommerce sites saw spikes in traffic comparable to the holiday-time shopping rush.

In May 2020, traffic numbers were already larger than the typical November-December spikes, and they only continued to grow, exceeding the 25 billion mark for monthly visits.

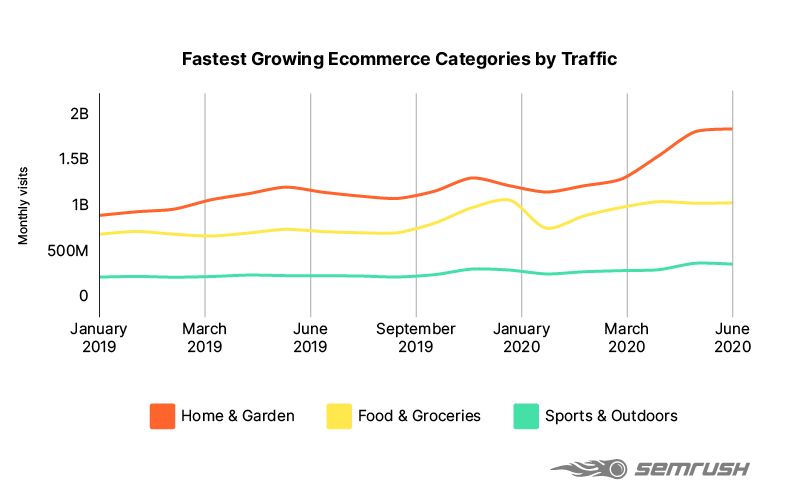

With stay-at-home orders and worldwide lockdowns, Home and garden, Food and groceries, and Sport and outdoors business categories are seeing the biggest increases during the pandemic months, growing at 40-50% YoY.

Business opportunities to get a share of the growing traffic

Exploring the newest traffic trends and looking at where the visitors come from reveals how ecommerce businesses can leverage the growing traffic trend:

- As mobile traffic accounts for 70% of all ecommerce site visits, optimizing a website for mobile with ecommerce-specific SEO tricks is the way to go.

- Given that 60% of all ecommerce traffic is direct, investing in brand awareness and customer loyalty can help businesses stay afloat in the sinking economy.

Global ecommerce digital ad spend is down

Ecommerce businesses are one of the largest online advertisers, with many large e-tailers among the top 10 digital ad spenders worldwide.

Yet SEMrush found that around 50% of all analyzed ecommerce businesses spend no more than $1,000 a month on search advertising campaigns.

Ad budgets tend to rise when competition grows higher, making General retailers and Fashion e-tailers the largest digital ad spenders within ecommerce. 50% of the analyzed businesses within these industries are spending more than $150,000 each month.

But the SEMrush data indicates that the coronavirus crisis has already had an impact on digital ad spend. And it’s showing a downward trend.

Advertisers of all sizes have reduced their digital ad budgets by an average of 20%.

(Missed) Digital advertising opportunities for ecommerce businesses

As there are fewer players within the digital ads field, the costs of online advertising are also down, meaning that businesses can now potentially attract more customers per dollar.

Allocating ad budget is not enough, though, as from category to category consumers react to different messages and triggers. Having analyzed the most popular CTAs by ecommerce industry type, SEMrush found that:

- ‘’Free shipping’’, “free returns” and similar triggers are present across 32% of all ads. With more consumers choosing online shopping because of the pandemic, this message is dominating the CTA landscape across all categories.

- Exclusivity and designer elements appear to be an important success factor for Home and garden category ads as well as Health and beauty (“limited edition”).

- Urgency and the novelty factor are obviously important to Sport and outdoors and Fashion industries, where “new arrivals”, “shop latest”, and “shop new” phrases are appearing in most of the ads.

- Quality triggers can help to seal the deal for a few of the categories like Pets (“vet recommended”), Groceries and food (“accredited business”), and Consumer electronics (“trusted since…”, “factory authorized”, “authorized dealer”).

Embracing the new market landscape and the ‘new consumer’

Adapting to the ‘new normal’ is a challenge many ecommerce businesses are already facing. Without closer attention to and insights about the fast-changing market realities, some will fail while others will strive. And sometimes the thin line between success and failure is having the right data and tools that can help to navigate through the changes.

Although there is no one-size-fits-all approach to making smart digital marketing decisions, these are the three core areas ecommerce businesses have to strengthen to stay in the game:

- Lean on data and insights to quickly spot any market shifts and upcoming trends.

- Constantly monitor competition and consumer demand patterns to amplify marketing strategies that embrace any shifts in behavior, from changes in traffic acquisition tactics to increased interest in online shopping to peaking content consumption.

- Tailor marketing messaging and use targeted approaches to fit the needs of the ever-changing consumer.

Olga Andrienko is the Head of Global Marketing at SEMrush. Together with her team she has built one of the strongest international communities in the online marketing industry. Olga has expanded SEMrush brand visibility worldwide entering the markets of over 50 countries.