Last year, digital ad spend totaled $209 billion worldwide, finally surpassing TV. That’s great news for the industry, particularly Google and Facebook, who took home about 60% of that revenue. The duopoly’s dominance is projected to wane, mostly at the hands of—who else?—Amazon. The quintessential retail disruptor, Amazon now poses an increasing threat to Google, which only highlights the growing relationship between ecommerce and paid search.

Limited space on the mobile interface

Most search traffic comes from mobile devices, but mobile commerce hasn’t overtaken desktop (yet). Still, today’s customer journey has more touchpoints than ever before, which means that mobile devices often factor into purchases, even if the actual transaction happens somewhere else. According to last year’s MultiChannel Merchant Ecommerce Report, 85% of shoppers have started a purchase on one device and finished on another.

That stat alone demonstrates how much paid search factors into online shopping. With much more limited space, shopping ads dominate the entire mobile screen. Look at the same query from a desktop and a smartphone, side-by-side:

Another relevant stat? San Diego-based SEO company Ignite Visibility analyzed 5,000 queries to compare ranking and click-through rate. About 47% of clicks went to the three-highest links. Mobile shoppers are, more likely than not, clicking on an ad.

Amazon as a search giant

Amazon is just as much of a search engine as it is an ecommerce platform. For the past few years, Amazon has been the starting point for more product searches than Google. At the same time, Amazon commands such loyalty that more and more shoppers don’t even look elsewhere, bypassing the search engines entirely. According to PricewaterhouseCooper’s 2018 Global Consumer Insights Survey, which included 22,000 people all over the world, 14% of consumers exclusively shop on Amazon.

As Amazon grows its advertising business, marketers are increasingly investing in the company’s own paid search products. When ClickZ teamed up with Catalyst, part of GroupM, for our Age of Amazon report, we found that 82% of Amazon Marketing Services users buy sponsored products, while 65% pay for both headline search ads and product display ads. The latter, similar to Google Shopping ads, represents the company’s fastest-growing ad product, with the highest sale-per-click.

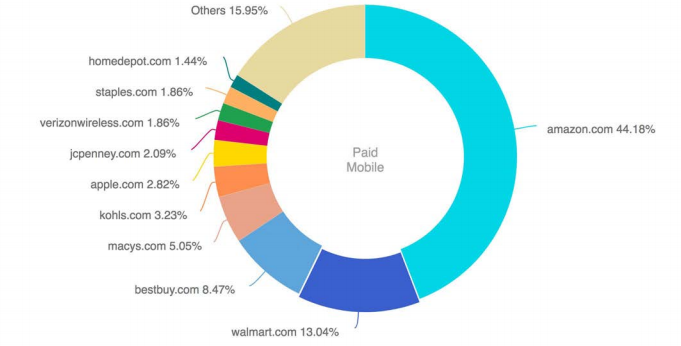

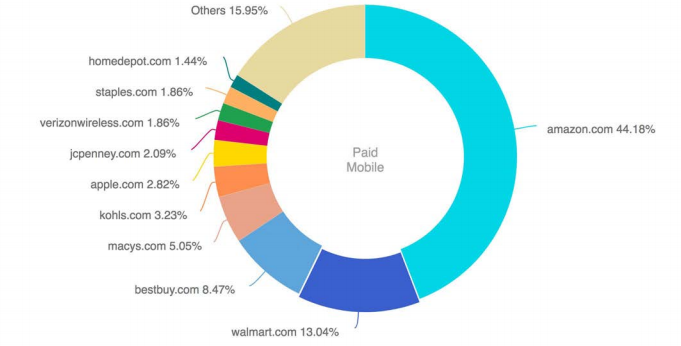

Not only a significant seller in the paid search space, Amazon is an aggressive buyer. This graph from the Digital Marketing Depot shows just how much Amazon dominates the paid search landscape in the consumer electronics category:

Google strikes back

Google and Facebook dominate ad revenue, while Amazon is currently in fifth place. By 2020, eMarketer predicts it will take the third spot, displacing Oath and Microsoft.

Last week, Google introduced a new AdWords feature called Shopping Actions. It allows consumers to make purchases directly from shopping ads through Google Assistant, which saves payment information and powers instant checkout. It also works across devices, which is noteworthy given the growing popularity of voice search, and platforms. Ulta is one retailer participating in the program, which means that customers can sync their Google and Ultamate Rewards accounts. Google can then make better, more personalized product recommendations. (You know, like Amazon does.)

Other retail partners include Target, Walmart, and Home Depot, all of which will give Google a cut of sales made through Shopping Actions. “How/where can I buy…” queries on Google have increased 85% over the last two years, which was the genesis of the program. But you can’t help but think Amazon was also a factor.