30-second summary:

- 61.5 million households around Europe have CTVs, of which, 60% of the UK use CTV as their primary source for watching TV

- British CTV viewers are tolerant of ads

- In fact, 69% of CTV viewers watch ad-supported content and around 58% said they prefer to watch ad-supported programming free of cost

- Ad-Supported Video on Demand (AVOD) is a very wide scope across the diverse UK consumer base

- The four CTV viewer base segments and ad targeting insights – Streamloaders, Jet Streamers, Do-it-all Streamers, and Silver Streamers

- More insights into their preferred screens, whether they consume ad-supported content, when they are watching CTV, and their interests

- What’s the best day to advertise on CTV? Find out!

CTV equals more advertising opportunities for Ad-Supported Video on Demand (AVOD)

Connected TV (CTV) might just mean “Constantly connected consumers” TV. CTV is the coming of age technology for consumers to access visual content connected through the internet, play on gaming consoles, etc. You must wonder, has COVID-19 affected CTV viewing and advertising? The answer will please you, smart marketer.

You’ll be surprised to know that 61.5 million households around Europe have CTVs. 60% of the UK use CTV as their primary source for watching TV. According to Samsung SmartLab+, the two key benefits were – 1. Convenience of accessing apps that improve content discoverability, and 2. Being able to access all TV content in one place.

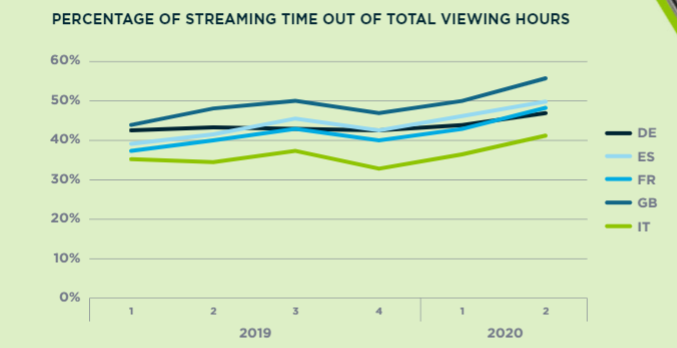

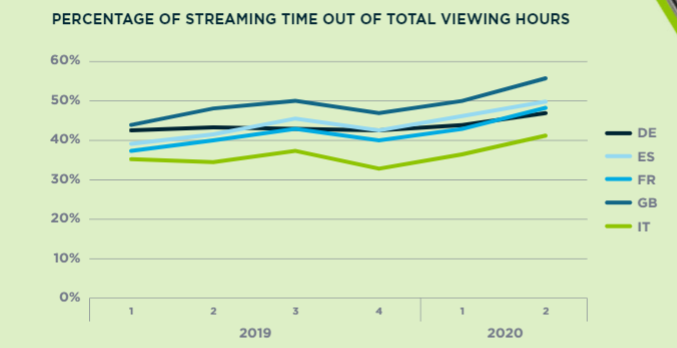

To help you derive a deeper understanding and optimize your advertising currency, we looked into SpotX’s survey that was commissioned by Statista. They dug into 18+ CTV consumers’ brains across Europe – UK, France, Germany, Italy, and Spain to know:

- Who are these CTV consumers?

- How tolerant are they of ads?

- When are they watching? And a lot more.

CTV consumer insights – UK market

Smart TV penetration has seen a progressive trend in the UK market and the best part is that it’s not affected by socioeconomic or geographical divides.

In addition to video on demand, 28% of respondents regularly watch live and simulcast entertainment.

Most streamers watch with a partner (61%) or with children and family members (32%). Only 24% say they usually watch by themselves. Households across major European markets owned an average of one to two subscriptions. Saturdays see the most viewership and Saturday nights reach the peak.

CTV is viewed almost daily across all age and income groups

British audiences are an assorted mix that watches CTV almost daily. The graph below shows that CTV consumption appeals to all age and income groups.

Who are CTV consumers?

Unlike popular myth, CTV appeals to all age groups across Europe’s Big 5’. Gen X comprised the largest viewership base with 43% while Gen Z and millennials had a combined 32%. Of these, 47% of daily viewers were male viewers and 50% were female viewers. 43 is the median age of CTV viewers across Europe’s Big 5.

The four audience groups and CTV viewing behaviors

The CTV viewer base is further segmented into four groups – Streamloaders, Jet Streamers, Do-it-all Streamers, and Silver Streamers. Here’s further insight into their preferred screens, whether they consume ad-supported content, when they are watching CTV, and their interests.

1. Streamloaders

The age group of 18-24 which comprised 11% of the respondents are Streamloaders. These were their audience insights:

- They access content from multiple sources and screens

- Watch ad-supported content on a daily basis

- Prefer watching in the evenings and late nights

- Their interests include playing sports, dining out, going to the movies

2. Jet Streamers

The age group of 25-34 professional millennials which comprised 21% of the survey respondents. These were their audience insights:

- They access a variety of streaming services

- Primary users of CTV

- Watch ad-supported content on a daily basis

- Mostly watch with a partner or children

- Their interests include dining out, attending concerts, attending sports events

3. Do-it-all Streamers

The do-it-all group between 35-54. They are working professionals balancing work and family who mostly live with a partner. These were their audience insights:

- Are mostly likely to have a household with children

- Particularly enjoy CTV’s flexibility and variety

- Watch ad-supported content vs paid subscriptions

- Their interests include dining out, home improvement and home projects, cooking

4. Silver Streamers

They comprise the 55+ group which comprised 24% of the survey respondents. They are typically baby boomers who are either retired or are nearing retirement. These were their audience insights:

- Are highly attracted to CTV’s flexibility and variety

- Prefer CTV to linear program viewing

- Most focused viewers as they do not multitask while watching

- Highly support ad-supported content vs paid subscriptions

- Their interests include traveling, reading, gardening

How tolerant are they of ads?

British CTV viewers are tolerant of ads. In fact, 69% of CTV viewers watch ad-supported content and around 58% said they prefer to watch ad-supported programming free of cost. It’s obvious that on-demand video trumps linear TV programming giving AVOD a very wide scope across the diverse UK consumer base.

Key takeaway for advertisers

70% of consumers said they do not spend more than £20 a year on streaming subscription services. Now is a fertile phase to invest in advertising on free or low-cost ad-supported platforms to grow within the UK market in the next 12 months.

All the above factors clearly state that CTV is the household favorite. And these insights give you a direct view of the who, what, when, and how of CTV advertising.

Marketers and digital advertisers can pair these insights with their specific data analyses to build personalized, well-targeted, ROI worthy campaigns.

ClickZ readers’ choice for the week

Our readers are venturing into expanding their knowledge on display advertising, social media, native advertising, and AR. While our Key Insights articles remain a favorite week after week. Observation shows that marketers increasingly seek interest and value in understanding the customer journey through these articles.

- A beginner’s guide to display advertising

- Why consumers follow and unfollow brands on social media

- Key Insights: Global deal drills, marketers’ cheat sheet, and the customer winning elixir

- The impact of native advertising across the customer journey

- Augmented reality examples: 10 industries using AR to reshape business