Yahoo Gemini slows down Q3 paid search growth

Yahoo migrated part of its search traffic to its own properties at the end of Q2 of this year. The shift is believed to have caused a decline in paid search budgets but is this just an interim trend?

Yahoo migrated part of its search traffic to its own properties at the end of Q2 of this year. The shift is believed to have caused a decline in paid search budgets but is this just an interim trend?

Yahoo and Bing amended their partnership in April of this year, giving Yahoo more autonomy to sell its own ads in its search results via its ad marketplace, Gemini. This change has had a great impact on search trends in the third quarter (Q3) of 2015, according to a new report by digital marketing company IgnitionOne.

The report also shows that in Q3, Facebook continued to outpace Google in display growth.

IgnitionOne’s report reveals that in Q3 of 2015, U.S. paid search spend increased by 12 percent compared to the same period last year, with click-through rate (CTR) and cost-per-click (CPC) up 25 percent and 10 percent, respectively.

While this is an impressive increase compared to Q3 of 2014, it is a slower growth rate than the last two quarters in 2015, according to the report.

The slow growth can be ascribed to the amended Yahoo – Bing partnership earlier this year, which gives Yahoo more flexibility to serve desktop and mobile search traffic on its owned-and-operated properties and networks.

“With Yahoo moving search traffic to Gemini, there has been a delay for marketers to move their budget there due to some usability issues, compared to other [search engines] and third-party tools not being fully integrated with Gemini. This spend that would have gone to Yahoo/Bing is not necessarily replaced by spend in other places in search, so it would be reflected in overall spend,” says Will Margiloff, chief executive (CEO) of IgnitionOne.

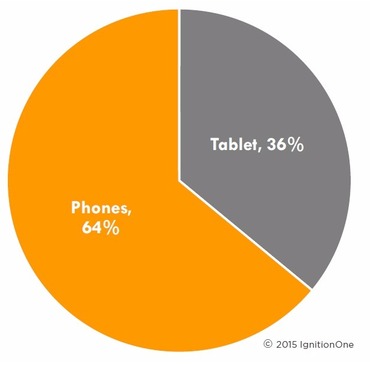

Meanwhile, mobile search saw a slower growth during Q3. Paid search spend on mobile phones was up 56 percent from the same period a year prior, while tablets were flat at two percent growth. This led to mobile search spend share shifting more heavily towards mobile phones at 64 percent.

Search trends aside, the report digs into programmatic display advertising as well. Compared to Q3 of 2014, programmatic display spend growth decelerated this year – up a mere seven percent – and impressions went down by five percent.

On a quarterly basis, Q3 spend in programmatic display grew three percent and impressions were up four percent from Q2.

A deeper look at different platforms shows that in Q3, Facebook continued to outpace Google in display growth, with Facebook ad exchange FBX up 40 percent in spend, while Google dropped 19 percent compared to Q3 of 2014.

Facebook’s market share held steady at 16 percent of the total programmatic display spend, while Google represents 27 percent, down from 35 percent last year. The cost of Facebook ads also continued to climb, with effective cost-per-thousand (eCPM) up 33 percent from last year, according to the report.

“Facebook spend growth can still be attributed partly to the fact that advertising on the network has gotten much more expensive since the previous year, as the number of ads on each page have decreased,” Margiloff says.

“And as Facebook works on improving its ad offering – for instance, improving visibility – its ads [will] continue to have increased value for the advertisers,” he adds.

In terms of display tactics in Q3, the report reveals a slight shift towards remarketing ads that represent 53 percent of the overall programmatic display ad spend. In comparison, reach (showing ads to as many people as possible with minimal targeting) accounted for 15 percent; look-a-like (ads shown to non-visitors who exhibit behavior similar to existing customers) represented 11 percent; and contextual ads had nine percent.

Prospecting ads are predicted to grow faster than remarketing ads in coming quarters. This is because prospecting ads such as look-a-like, contextual, custom targeting, and reach, can extend to a broader audience.

“Remarketing ads have a limited possible audience due to delivering ads to people who have visited your site in the past. In contrast, prospecting delivers ads to the much larger segment of people who haven’t yet been to your site but share characteristics of your audience. As marketers become more sophisticated and desire to reach a wider audience, this prospecting spend has much more room to grow,” he explains.

While IgnitionOne’s report reveals some interesting figures, it is still too early to tell whether Q3’s paid search slump is due to marketers getting to grips with Gemini’s infrastructure and therefore not quite ready to shift their budgets onto this platform, or whether there is a genuine decline in spend compared to previous quarters.

For programmatic display, Facebook continues to show strong growth with a 40 percent year-over-year increase. It will definitely be interesting to see how the next 12 months pan out and whether the social network’s display market share surpasses Google’s in its entirety.

Homepage image via Flickr.