The Internet Trends report by Mary Meeker of KPCB is one of the most highly-anticipated presentations in our industry each year.

Its 300+ slides dart through all the global factors that shape the marketing and communications ecosystem, from macroeconomic data down to search query trends.

Charts and statistics are delivered at such a rapid pace that they of course require contextualization before their findings can truly shape business decisions.

Within this article, we will look specifically at the economic and technological developments that are shaping consumer behavior in China. We will then add context to these findings, building on our recent assessment of WeChat’s explosive growth in China.

Some of the key trends from the report that we will dive into are as follows:

- Chinese ecommerce grew 24% YoY in 2016

- Mobile internet usage surpassed TV last year

- The battle for mobile payment supremacy between WeChat and Alibaba is crucial

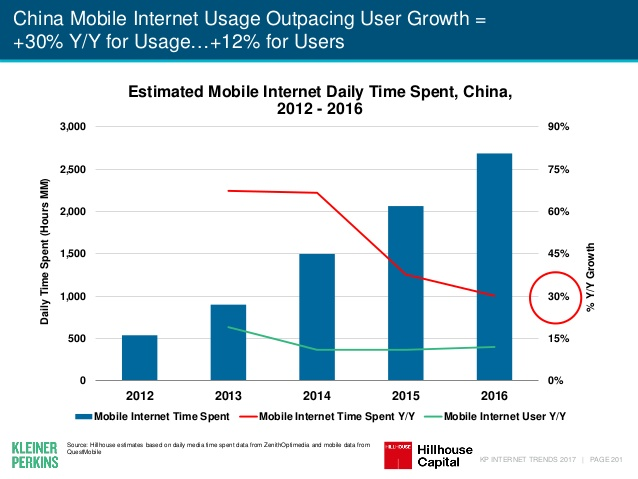

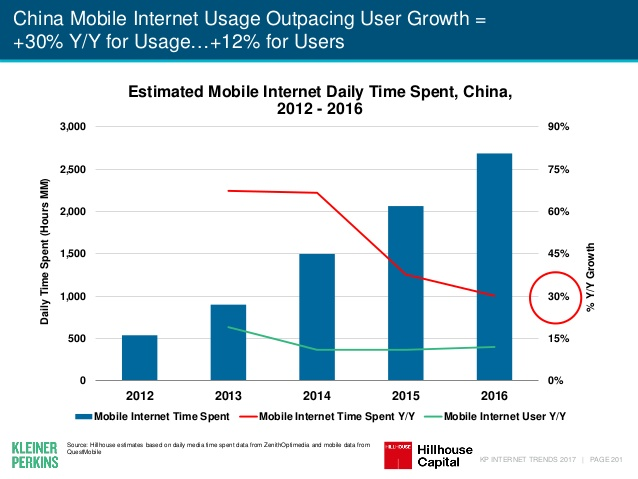

- Internet usage is outpacing user quantity growth

- Gaming and livestreaming represent the biggest monetization opportunities

- Ad fraud remains a challenge in China, as it is in the West.

Continued economic growth

China’s economy looks set to grow at a rate of 6.5% or higher in 2017, compared with 6.7% growth last year. Doubt has been cast on the veracity of these figures, however, with some Chinese officials speaking out to suggest they are artificially inflated.

Nonetheless, even if we require proxy data sources such as electrical output quantities or advertising spend figures to substantiate the government’s statements, there can be little doubt that China’s economy has grown very significantly over the last decade.

The proportion of that growth that is driven by private enterprises continues to increase, up to 48% in 2016.

Even more tellingly, the boom in private enterprise is driven by the technology sector. Not only do technology companies account for more private wealth creation than any other vertical in China, they have also shown the most significant growth over the last decade.

Interestingly, the next big area for digital expansion in China is predicted to be the country’s very sizeable rural population. JP Morgan reported recently that of the anticipated 160 million new internet users in China by 2018, only 10.6 million will reside in Beijing, Guangdong or Shanghai.

Supported by improved infrastructure and larger distribution warehouses for China’s ecommerce giants, that could open the door to a vast number of prospective new digital customers.

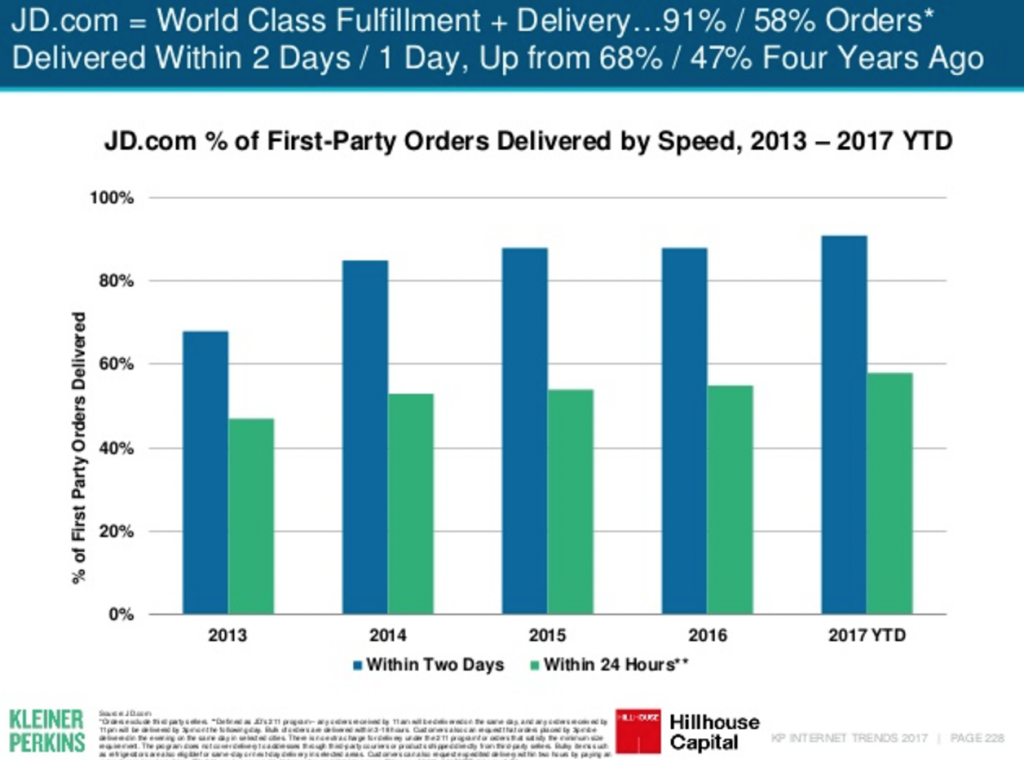

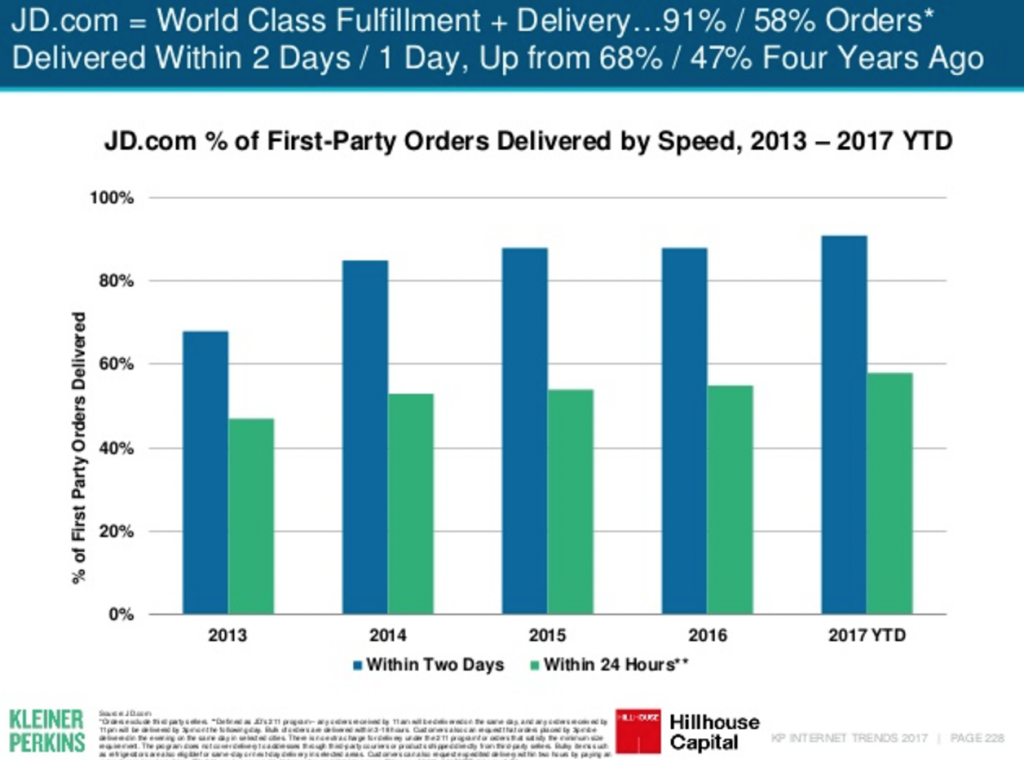

JD.com (an Amazon equivalent in China) has invested heavily to stay ahead of this trend, with 91% of its orders now delivered within two days.

All of this has been keenly watched by CMOs and CEOs, always on the lookout for the next big opportunity.

Identifying the opportunity and capitalizing on it are interrelated, but sometimes loosely so when it comes to China. There is a lot that we need to understand if we want to use digital marketing platforms in China and – most importantly – forge a genuine engagement with consumers.

Advertising in China: The bigger picture

One can sense already from the macroeconomic statistics that the most profitable areas for global brands will be in monetizing an already-engaged, young, urban, digital audience, while also preparing to maximize the potential of an increasingly connected rural population.

Growth in digital advertising revenue in China is outpacing the country’s economic growth, up a further 30% on 2015’s figures. This drove the total online advertising spend across China to $40 billion in 2016, compared with around $72 billion in the US.

The rate of increase is slowing in China, but an annual growth rate of 30% suggests we are still quite some distance from a saturation point.

It is no surprise that most of this spend is now going towards users on mobile devices, in line with what we see in other territories.

That said, the gross value of products purchased online skews very heavily towards mobile over desktop. In relative terms, the growth in mobile spend has slowed. In absolute terms, B2C mobile spend on products online has now topped $400 billion.

It seems clear that consumers are moving their purchasing behavior, as well as their browsing, to mobile devices.

What are the key opportunities for marketers in China?

The ineluctable question that follows these charts is: How are people spending their time online?

Growth is the common theme across all of the main areas of internet usage: social media, video consumption, gaming, search engines, and internet browsers continue to post impressive increases.

A burgeoning middle class with more time and resources to spend on entertainment means that all of these areas stand to benefit from increased user engagement for some time to come.

As can be seen from the chart above, there are some common threads throughout this list. Essentially, if you plan to advertise in China, you will need to engage with Baidu, Alibaba, and/or Tencent.

This advertising ‘triopoly’ is expected to take well over 60% of Chinese advertising spend this year and, with Facebook and Google locked outside this lucrative market, their stranglehold will likely tighten over time.

Although the Chinese ad giants play almost exclusively on their home turf, they still take 15% of all global digital advertising spend between them.

Digging a little deeper into these high level figures, there are some core areas of competition that will shape the Chinese marketing landscape in 2017 and beyond.

Mobile payments

The smartphone revolution took hold in China long before a lot of other markets, so it stands to reason that the number of handheld devices shipped no longer grows at an annual rate of over 20%. The market is expanding, but the majority of citizens are now in possession of at least one smartphone.

What we do observe, however, is that the amount of time spent on mobile devices continues to rise rapidly.

One reason for this is that Chinese consumers have come to see their mobile devices as a way to get just about everything done on a daily basis.

It is very common for people to use their smartphone rather than a credit card or cash to make all of their payments. The number of mobile payments more than doubled in 2016 compared to 2015 and this trend will continue. As we saw in our introduction to WeChat, mobile apps have now become self-contained digital ecosystems that allow people to make friends, donate to charity, hail a taxi, and buy their groceries.

For marketers, this means we have to ensure that our brands are integrated with these payment systems or we will lose out. It is also essential to have an optimized ecommerce presence within both WeChat and Alibaba to allow consumers to discover your products first.

Both platforms require a separate strategy and they hold some new opportunities when compared to Google or Facebook, but the level of competition is fierce and only the most popular or innovative brands tend to cut through.

Gaming

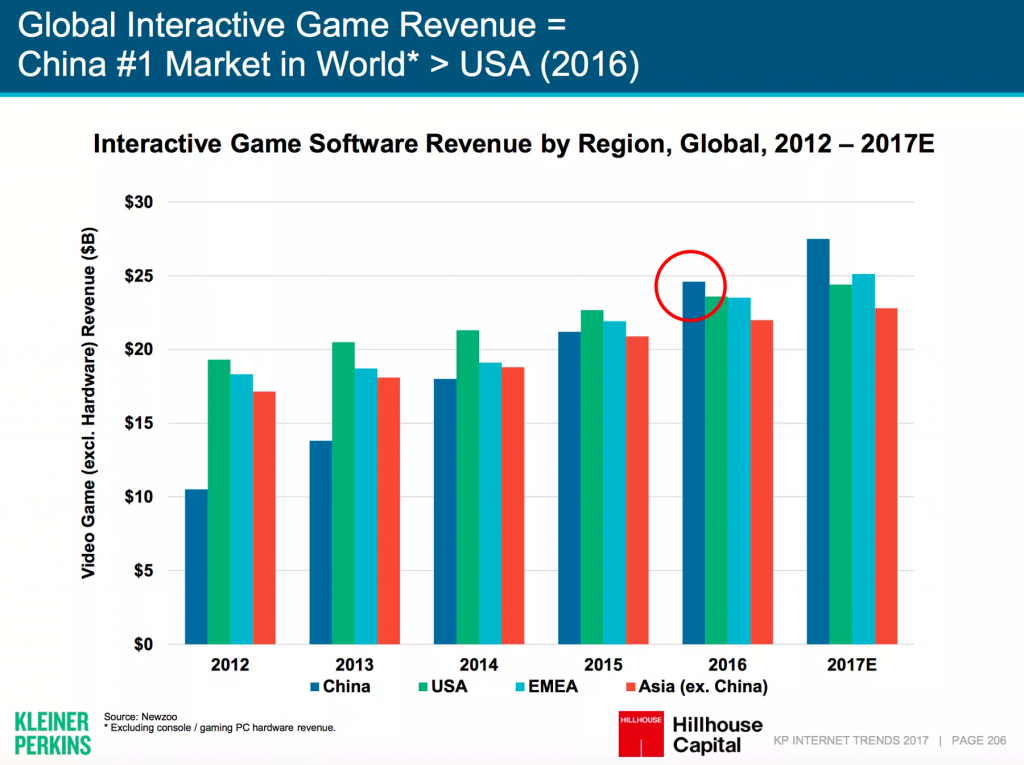

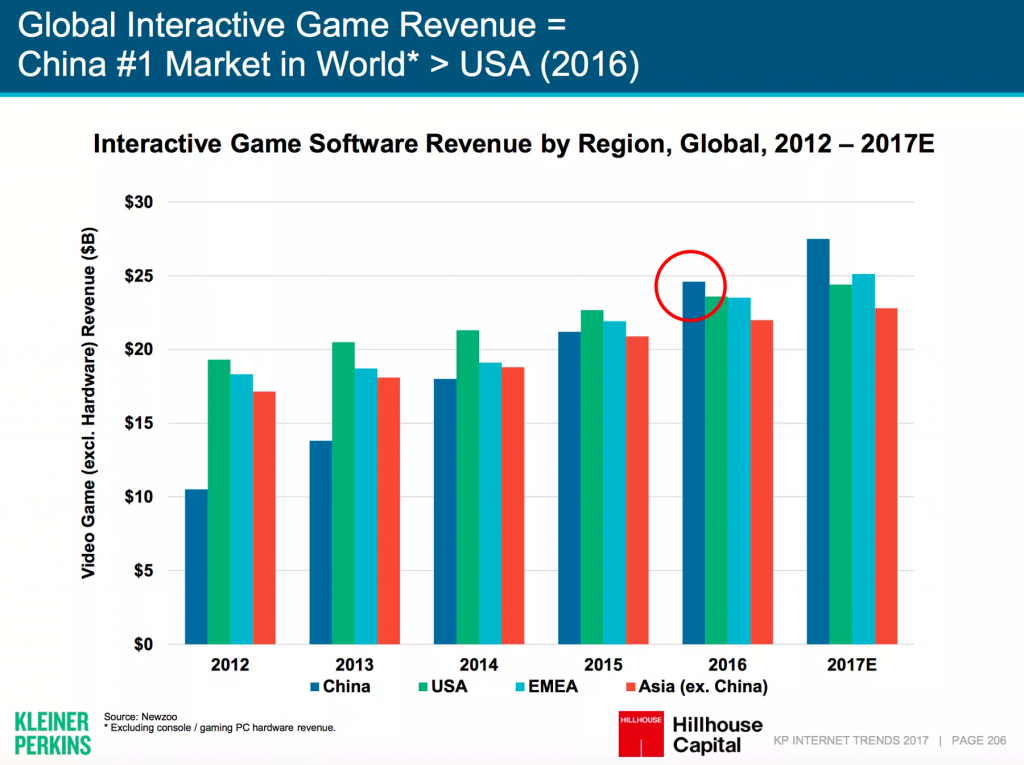

We have written recently about the potential for gaming to assume a prominent position in any brand’s marketing armory. China is not only at the forefront of this trend, but is also estimated to pull away from other nations through 2017.

Tencent posted gaming revenues of almost $4 billion in Q1 2017, so the willingness to pay to play is very apparent.

The obvious opportunity here is for game developers and in-app banner advertisements, but there are numerous ways to integrate products and services within these apps too.

Chinese consumers are comfortable with the fact that they will have to make in-app purchases to get the most out of a game, so this is a medium ripe for monetization. In an age of such limited consumer attention spans, gaming is something of an anomaly. Savvy marketers are making the most of this, in China and in the West.

On-demand transportation

The nature of living in one of China’s sprawling urban centers is that on-demand transportation is a particularly appealing prospect. Apps like Didi (the Chinese version of Uber) and Mobike (a bike-sharing app) have been the prime beneficiaries of this trend.

It is worth assessing the above chart in a little more depth. The quantity of on-demand trips in China dwarfs that of any other nation; in fact, there are more on-demand bike trips in China than there are of any type in any other nation.

This is perhaps of most interest because of what it tells us about Chinese society at a more profound level. There is a higher degree of willingness to share products among consumers, and this reaches far beyond just car- and bike-sharing apps.

Therefore, the opportunities that this trend opens up for marketers are two-fold. Undoubtedly, there is profit to be made by integrating with the existing giants in the space and offering supplementary services, much in the same vein as restaurant collaborations with UberEATS.

For more intrepid marketers, there is also an opportunity to seize on this thirst for product sharing and offer something new altogether. Recent innovations have even seen the launch of umbrella- and basketball-sharing apps, for example. Some argue that China has already reached ‘peak sharing’, but others see this as reflective of a society that is open to new solutions to common quotidian problems.

Livestreaming

As with gaming, Chinese consumers are open to paying for livestreaming services. The variety of streams available is impressive; everything from karaoke to sports to local news is covered. Facilitated by the aforementioned, slick payment systems within Chinese smartphones and apps, livestreaming has become one of the most valuable forms of digital entertainment.

There is also a relatively new stratum of Chinese society populated by digital influencers. These personalities use the immediacy of the internet to their advantage, so it is a natural for for them to engage with livestreaming. Brands can partner with influencers, although (as is often the case in the US) this practice is still nascent and not quite as subtle as other forms of marketing.

However, livestreaming is not without controversy. Weibo, which has long been a dominant social media player in China, recently had its livestreaming services suspended by the authorities. The charge leveled against Weibo was that these services “disseminate opinions potentially harmful to social stability.”

This hints at another simmering tension in China. The country is growing and embracing modern technologies, but this can occasionally jar with the political system. Internet censorship becomes nigh-on impossible with millions of concurrent, live streams.

China and ad fraud

AdMaster (essentially the advertising watchdog in China) reported that almost one third of all advertising traffic in 2016 was “invalid”.

This problem is far from unique to China (quite the opposite) and is one of the biggest challenges we all face globally. It is, therefore, worth noting for any marketers planning to launch campaigns in China that this is a serious and ongoing issue.

A number of innovative solutions have been supported and there is willingness from all parties to stamp out fraudulent ad traffic, so there is plenty of room for optimism too.

Source: AdMaster Advertising Measurement

In summary

Mary Meeker’s Digital Trends 2017 report brought more than enough new information to keep us busy until next time. Nonetheless, what we have mainly seen in China are continuations of trends from last year.

Tencent, Alibaba, and Baidu still dominate the advertising landscape, although the latter requires some development if it is to keep pace with changing user behaviors.

There is very positive growth in the amount of time spent online and Chinese consumers are spending more via their mobile devices than ever before.

As one would expect from such a vast population, the landscape is quite fragmented and it is only in understanding the psychology of internet users in China that marketers can maximize their returns.

As frequent internet usage becomes the norm in urban and rural areas, the opportunity in China continues to grow – both in its potential and its complexity.